Pitching VCs? Use This Reverse Psychology Trick To Get Funded

You’re planning a big adventure — skydiving or swimming with the sharks, for example — you’ve probably got the details mapped out.

Except for one — the life insurance. Are you covered in the unlikely event that your big adventure goes wrong?

That’s where Matt Randall, previously of Twyla, and co-founder Maria Miller, an insurance executive, saw an opportunity.

Their company, Spot, offers instantaneous short-term life insurance coverage starting at $7 per day.

“Imagine Red Bull or GoPro created an insurance company,” Matt says, describing Spot.

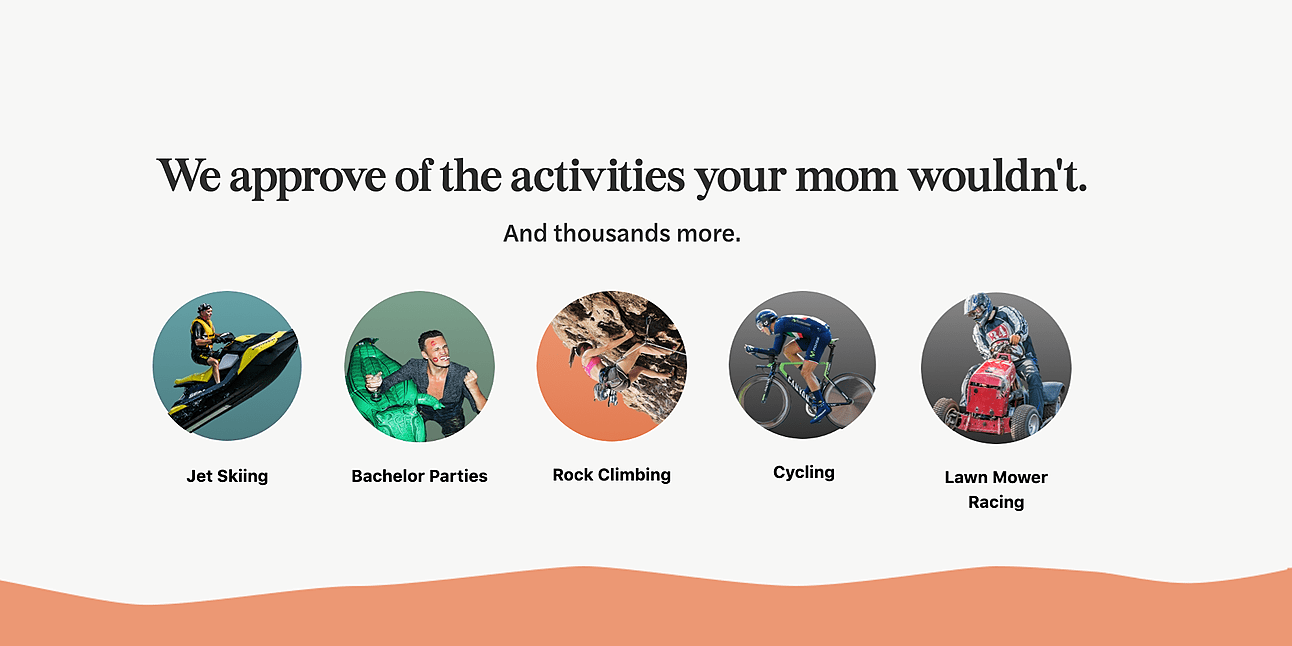

Spot positions itself as a new insurance company for the “adventurous spirit,” covering things like mountain biking, snow skiing, taking your kid to the trampoline park, and even bachelor and bachelorette parties (at least, the really crazy ones).

“We cover pretty much anything and everything. We even cover lawnmower racing, which I think is hilarious. I don’t even really know what it is, but I look forward to doing it,” Matt says.

When we spoke, Spot had raised almost $6 million and Matt shared the in’s and out’s of his fundraising journey. Based on our conversation, here are five takeaways for fundraising success.

1. Stay in the driver’s seat: Angels before VCs

Matt was very deliberate about doing an angel round before a seed round.

“We decided to structure a convertible security,” Matt says of his and co-founder Maria’s strategy. They knew they’d be giving away about the same amount of equity compared with working with VCs, “but it was going to be in tiny little slivers to multiple, different people,” he says.

In his view, adding VCs early on is like bringing in another co-founder. “While you’re still understanding the business … you just put a gigantic whale on your cap table that now has a big say in your business.”

Working with angel investors instead would ensure that Matt and his co-founder retained “major control over the whole entire thing,” he says. “We could select the type of investors we wanted to go after that would help us scale the company.”

When it came time for the seed round, they went with the relatively small Austin-based Silverton Partners — even though the round was oversubscribed and some larger firms from Silicon Valley had thrown their hats in the ring.

Matt’s thinking was that you can always go back to a big firm for “a much larger check” down the road. A smaller firm might not be an option once you get into larger rounds of funding, which is why they chose Silverton to lead the round.

2. Pitch the vision over numbers

Matt shares a tip from one of his startup mentors: “In the early days of pitching, you’re pitching a vision. You’re not pitching the numbers you currently have or anything like that.”

For example, in his fundraising decks, Matt says he focuses on the storytelling and describing why the company will succeed. He doesn’t even include revenue numbers.

“You’ve got to use a little Barnum & Bailey and a little smoke behind the mirrors,” he says.

In the early days, “MRR, that just doesn’t paint a giant picture.”

3. Offer rewards for strategic introductions

When it came to Spot, Matt and Maria were in a good spot: they didn’t have to raise money. But while on a trip to LA for his mom’s birthday, Matt set up some meetings to gauge investor interest.

In exchange for some advisory shares, he asked a well-connected contact to introduce him to LA-based VCs. This contact helped connect him with several investors — beyond the ones he met with on his LA trip.

“He introduced me to 30 VCs around the country that I didn’t know. It was 100 percent worth the advisory shares for introductions all over the country,” Matt says.

4. Use a little reverse psychology

“The best advice I was ever given was, ‘Ask for advice, get funding. Ask for funding, get advice,’” Matt says.

A typical fundraising strategy is to describe why you have the best team in the world or to explain why the company will be worth a billion dollars. This gets investors into the mode of looking for holes and finding ways to prove the entrepreneur wrong.

Matt takes the opposite approach. “I flip it around and say ‘With your past experience, can you help me validate what I’m thinking and how you would look at it?’” he says. “It’s this chess game that I play.”

“I’ll say, ‘Hey, I’m starting up this insurance company, and we’re kind of creating this new channel in the market,’” Matt says. “‘But what I would love to learn from you is, how you would pitch this idea?’”

It forces the VC to consider the company’s selling points. In the process, they might just convince themselves why it merits investment.

Matt remembers one investor who got really excited when he asked him for feedback about scaling customer acquisition costs for Spot.

“Once I framed it to him that way, he started looking at it from an operations type role,” Matt says. “Within 15 or 20 minutes, he was asking me what’s the biggest check he could write to the company.”

5. Build your network (from all angles)

Even with a unique approach, fundraising was still a grind for Matt. He got a lot of no’s from investors who thought the idea was just too big.

For Matt, the keys for successful fundraising are to seize opportunities and build up your network.

“We raised $100,000 early on from a guy who was sitting next to me in a restaurant,” Matt says. “Opportunity is always right next to you. It’s about going after it and not being afraid to be told no.”

Even when he gets a no, Matt says he always asks the investor to make further introductions. He’s constantly networking and has attended many events over the years to meet people. The culmination of these efforts has helped him build a solid network of high net-worth individuals.

“To me, it’s the reaching out, finding people with good networks, and finding a way to meet.”

https://button.like.co/cracacoa

喜欢我的作品吗?别忘了给予支持与赞赏,让我知道在创作的路上有你陪伴,一起延续这份热忱!