The 20 Slides That Raised $7 Million

Fundraising is a funny art.

It’s a play in 3 parts: The Wind-Up, The Execution and The Close.

The Wind-Up

In the Wind-Up, you’re setting the stage. Rarely is a fundraise accomplished from a cold start with cold relationships, so a Wind-Up often takes many months of getting to know venture capitalists and other investors. No pitching, no hunting. Just casual glad-handing, coffee meetings and character-setting.

A good Wind-Up will inform who you have chemistry with. Nothing will happen without chemistry.

In the final weeks of a wind up you’ll be laying some breadcrumbs. You’ll be offering that you’re thinking of a raise.

You’re evaluating if now is the right time.

Don’t start if it isn’t.

VCs are meeting masters so if your Wind-Up has been strong, you’ll be offered plenty of chances to meet and pitch. You’ll reach out to anyone you haven’t met during your early wind up to let them know that, “while you know a number of folks you might want to raise from, you’re trying to get to know a few others — just to be sure you haven’t missed anyone great.” No VC likes to be left out.

Oh. In your Wind-Up you have been fastidiously refining your vision while generating indicators that there’s a business to be polished. And your team has to be quality. Go ahead and get rid of that dead weight before you raise.

You’re never really ready, so forget about that.

Momentum will tell you when it is time.

The Execution

Lace up, because good fundraises happen fast. And they can happen any time of year (forget that crap about August being a bad time to raise. Do the rest right and the summer season becomes irrelevant).

You’ll want to set discussions up with Partners, not Associates. Associates are awesome, but they’re just one step further away from the truth. Principals are ok, just know you’re going to have to have a few more meetings than you should.

Pitch live when you can. Pitching via video works, too (zoom finally made this work well enough). Don’t pitch on a phone call. Always pitch with a deck. Pitch in an office, not a coffee shop. Pitch without Randos walking behind you all the time (no one cares about your shared office space).

Decide on your pitch partners. If you can, pitch solo first, then bring in the big guns (i.e.: CTO / Head of Data Science at Flipside Crypto) for the second pitch once someone is hooked on the vision. Saves your team’s time; saves something “new” for the second pitch.

Well executed pitches are a series of stair steps, with each step allowing you to meet the next objective.

Fundraise Stair Steps

- Hammer initial pitch meetings with as many investors as you like in 2–3 weeks. Find someone to lead (step up)

- Tell other investors you have a lead (step up)

- Find out what every else wants to invest and get people to commit to a spot (step up)

- Pit investors against each other to create pressure on close dates (step up)

- Meet other investors all throughout the process because you never know how momentum will change your story (nothing like a nearly closed round to excite new investors) — or who will drop out.

Finally. Finally, finally, finally. Your deck will be critical. A few rules:

- Make it memorable. Venture Capitalists see ridiculous amounts of decks. So help them remember yours. Slides should tell the story with ZERO voiceover — what you add in a pitch should be color. Speaking of color, get to know Unsplash and 500px and your slides will do the work for you.

- Fit the patterns. Venture Capitalists also have a shopping list they need to check off: team, model, traction, competitive landscape, TAM (total addressable market), etc.. Don’t leave anything out. And, Goddamn it, know how much you want to raise before you start.

- Present it first, send it second. I actually broke this rule once in this recent raise and know what? I was totally ghosted 👻. And now the cover page of our deck looks…just…like…the…cover…page…of…the…website…of…a…competitive…org…that…is…a…portfolio…company…of…that…VC. Shame on you people.

Enough throat clearing. Here we go:

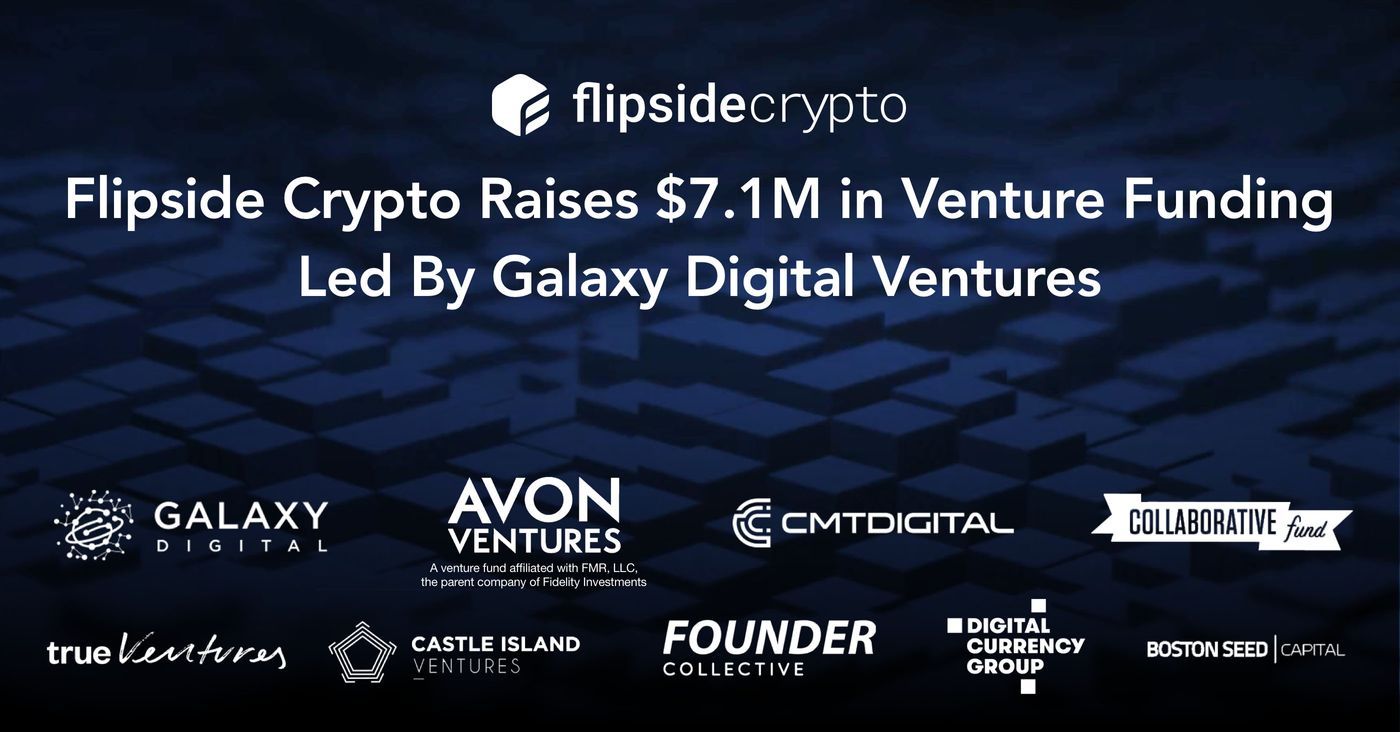

The financing round was led by Galaxy Digital Ventures with participation from Collaborative Fund, CMT Digital and Avon Ventures, a venture capital fund affiliated with FMR LLC, the parent company of Fidelity Investments. Previous investors True Ventures, Founder Collective, Digital Currency Group, Castle Island and Boston Seed all participated in this financing round as well.

https://button.like.co/cracacoa

喜欢我的作品吗?别忘了给予支持与赞赏,让我知道在创作的路上有你陪伴,一起延续这份热忱!